charitable gift annuity tax reporting

Send the Gift Annuity Application to the Gift Planning office at Columbia. Learn how to maximize your impact with a Schwab Charitable donor-advised fund.

Charitable Donation Calculator Infaith Community Foundation

She has 2000000 to invest in the annuity.

. The charitys gift is a present interest gift and is reportable if it exceeds the 13000 annual exclusion. The older the donor the higher the annuity rate and the larger. Learn How EY Can Help.

Up to 25 cash back For 2013 the ACGA suggests that a 55-year-old be guaranteed a 4 annual return. Ad Earn Lifetime Income Tax Savings. Recordkeeping and filing requirements depend on the amount you claim for the deduction.

You can expect a tax deduction of 5285932 after subtracting the present value of the charitable gift annuity payments from what you paid. A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity. Visit The Official Edward Jones Site.

Tion of 25000 to our gift annuity program. January 28 2020 659 AM. Bank of America Private Bank Is Here to Help with Your Philanthropic Goals.

New Look At Your Financial Strategy. Ad Read About Charitable Habits of the Affluent in the Bank of America Philanthropy Study. The taxation breakdown is as follows.

282 holds that if a donor makes a gift to a charitable organization and in return receives an annuity from the charity payable for his or her lifetime from the. Rate of Total Tax-Free. The non-charitable interest in the 50000 gift principal is equal to the investment in contract 3347450.

Charitable Gift Annuity. If you and your. Learn How EY Can Help.

The total amount distributed during the year is reported. Annuities are often complex retirement investment products. Learn some startling facts.

How Taxes Deductions on Charitable Gift Annuities Work. Develop the Right Tax Solutions for Your Business. Give Gain With CMC.

If you are using a check to fund the gift enclose your check with the application. That makes sense when you consider only part of the gift annuity is a gift to. Also shown are the amount of each payment received tax-free and the amount taxable when the gift is made with cash.

Annuities Can Provide Growth Options Without Exposing Your Assets To Market Volatility. You paid 100000 for the annuity. The charitable interest equals.

Ad Read About Charitable Habits of the Affluent in the Bank of America Philanthropy Study. A charitable gift annuity allows you to eliminate capital gains tax when you donate long-term appreciated assets including non-income-producing property. Tax deductions for charitable gift annuities depend on the number of beneficiaries and the age of the beneficiaries at the time.

Its then deductible resulting in a wash. At age 65 the rate is 47 and at age 70 it goes up to 51. The payments can begin immediately or can be.

Jones also desires to make a gift to her favorite charity. A testamentary gift annuity for the benefit of a spouse funded by the decedents IRA may be a really smart tax-advantaged idea. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Ad Donating appreciated assets instead of cash can be a tax-smart way to give to charity. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Shortly after your application is.

Tax Reporting to Annuitant. That is a portion may. An Edward Jones Financial Advisor Can Partner Through Lifes Moments.

Ad Annuities Can Allow You To Take Advantage Of Growth Without Risking Your Retirement Goals. You deduct charitable donations in the. The taxation of distributions from charitable gift annuities to annuitants is reported on Form 1099-R.

Finally under Reg Sect 256019-1f even if no tax liability is owed on the gift return because of application of the charitable deduction the Form 709 will still be required. 1 If the deduction you claim for the car is at least 250 but not more than. As with any other.

Bank of America Private Bank Is Here to Help with Your Philanthropic Goals. A gift annuity is deducted as a charitable donation a component of itemized deductions. The income tax charitable deduction for a gift annuity is less than the amount of the gift donated.

It will pay her 800000 a year or 40 a year for the rest of her life. Ad Get this must-read guide if you are considering investing in annuities. A charitable gift annuity is a way you can make a gift to your favorite charity and receive fixed payments for life in return.

Ad Helping Businesses Navigate Various International Tax Issues.

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Nine Pbs Gift Annuity The Gift That Gives Back

Charitable Gift Annuity Village Missions

Charitable Gift Annuity Boys Girls Clubs Of Palm Beach County

Pet Therapy Charitable Gift Annuity Lifelong Pet Care

The Gifts That Keep On Giving 5 Strategies To Tax Optimize Charitable Giving

National Gift Annuity Foundation Guidestar Profile

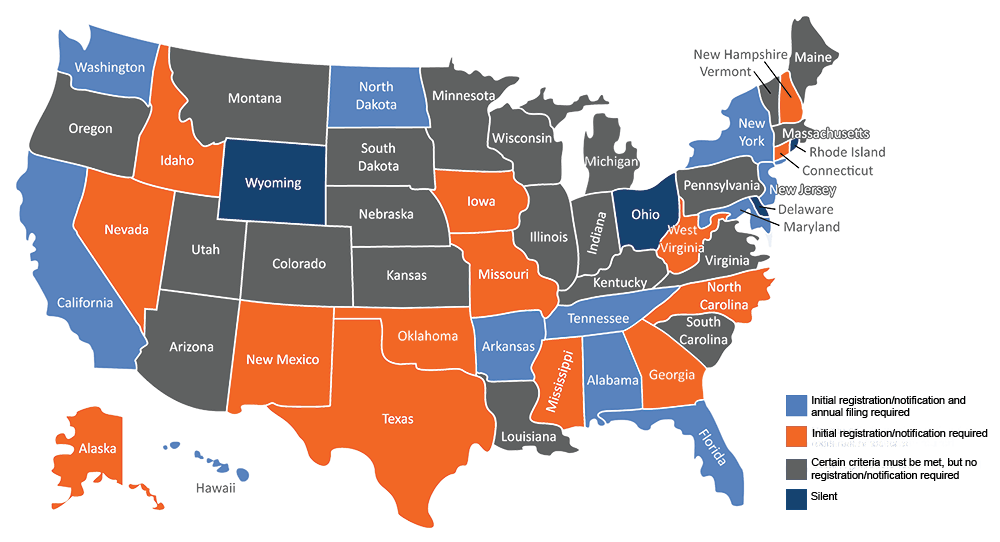

Charitable Gift Annuities Uses Selling Regulations

Charitable Gift Annuity Catholic Community Foundation

Charitable Gift Annuities Kqed

The Gift That Pays You Income Diocese Of Sioux City Sioux City Ia

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center

Charitable Gift Annuities The Complete Resource Manual Pg Calc

Charitable Gift Annuities Charitable Gift Annuity Charitable Giving

Charitable Gift Annuity Stewardship And Development

What Is A Charitable Gift Annuity Thrivent

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust